How To Remove 18 Gst From Total In Excel

Its difficult to find. 1 let us assume X as the actual price.

How To Use The Excel Ceiling Function Exceljet

The Subtotal dialog box willappear.

How to remove 18 gst from total in excel. How can I remove the tax from a total to get the pre tax value. In the dialog box click on Remove button in the bottom left corner. For calculating GST a taxpayer can use the below mentioned formula.

Know matter what I try I cannot seem to get the correct value. Also we consider GSTR 2A changes could be happen for an hour or a day or a week. Start to removing this Bold and spaces and spending a Huge time unknowingly data deleted May be.

Net Price Original Cost GST Amount. If I try to remove 175 UK Value Added Tax from a total its also calculating the additional 175 on the original value as well. In this Microsoft Excel blog post we will show you how you can calculate tax deductions for any amount and how to remove a tax deduction without having to include any taxes Whether it is GST or income tax GST or Income tax formula in excel.

In order to add GST to base amount Add GST GST Amount Original Cost GST 100 Net Price Original Cost GST Amount. I do not always know the PST amount witch is 8. Learn how to write formulas in Excel to calculate GST at 15.

Now first of all write down the amount you want to calculate tax in column A. Price including VAT Price Tax To calculate the price including VAT you just have to add the product price the VAT amount. Lets assume that a product is sold for Rs.

Click on Subtotal in the Outline group. He quotes in GST Inc so I need a formula for excel that will break down the Total and show the GST component of it. In order to remove GST from base amount Remove GST GST Amount Original Cost Original Cost 100 100 GST Net Price Original Cost GST Amount.

The GST amount on the product is 909. All worksheet data will. Every time we have to spend a time for removing these spaces Bold characters to reconcile.

For example if you paid 10 for an item you will have paid five percent or 50 cents in GST. First we take the price of the product 75 And we add the calculation of the amount of tax. Here I Introduce GSTR 2A Online Data Space Bold character Tool.

This thread is locked. 100 divided by 11 909. Formula to add the price and the tax.

GST Amount Original Cost Original Cost x 100100GST Net Price Original Cost GST Amount. If we were to simply subtract 10. Make sure that the Online GST calculator you choose provides accurate information.

I need a formula that calculates the -5 GST I can not just subtract Total - GST. That is equal to X018X2065. Trying to help out a mate with a simple invoice system in excel.

Our GST calculator will calculate the amount of GST included in a gross price as well as the amount you should add to a net price. You can follow the question or vote as helpful but you cannot reply to this thread. So 100 is the gst component.

This also helps you do some practice in Excel------Please watch. Multiply by 3 divide by 23. Calculate the GST component to be added to a GST exclusive.

How to use our GST Calculation Tool. GST levied under Reverse charge should be deposited to the government by 20th of every next month. Subtract this number from the amount you paid to find the original price of the item without GST added on.

Explanation of the calculation. I have the same question 3 Subscribe. So the end amount should be 6477.

Is it just 1000 x 01 100. 2000 and GST applicable to that product is 12. Do not worry Online GST calculator by LegalDocs will help you to get the accurate result within a short span of time.

Divide the bill for the goods or services by one plus the GST. Having a major brain fart and cant get my head around it I know its so simple. 2 so the total amount is X actual price18 of the actual price2065.

Example shown 300 is the GST amount. Multiply the amount you paid by the decimal you found in Step 2 to find the total amount of GST on the price of the item. 909 multiplied by 10 GST rate of 10 9091.

GST Amount Original Cost x GST100. How do I remove the 5 gst from excel office and add 13 How do I remove the 5 gst from excel office and add 13 OFfice 2010. We at Paisabazaar offer to taxpayers a dedicated and professional GST.

This Excel tutorial shows different techniques to calculate and find GST amounts. This is your bill without GST. To calculate the GST on the product we will first calculate the amount of GST included then multiply that figure by 10 The GST rate.

I am trying to take out the GST witch is 5 from the total. In the example if your bill including GST was 229 then 229 divided by 105 equals 21810. Subtract your bill without GST from Step 2 from the bill for the goods or services with the GST to find the GST.

You can also calculate the value of your product with tax in a single formula. The GST-exclusive price of the product is 9091. In the tutorial I show you how to.

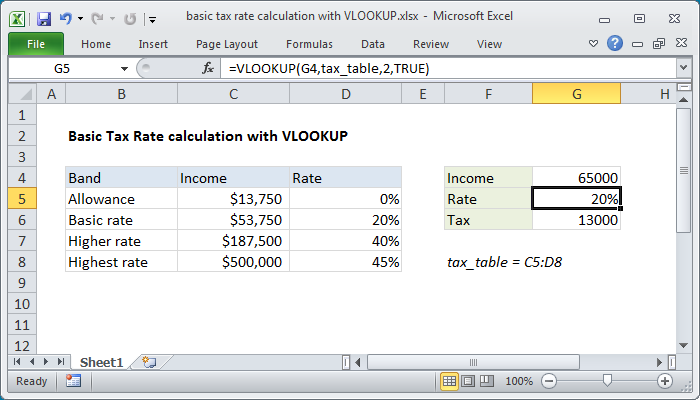

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

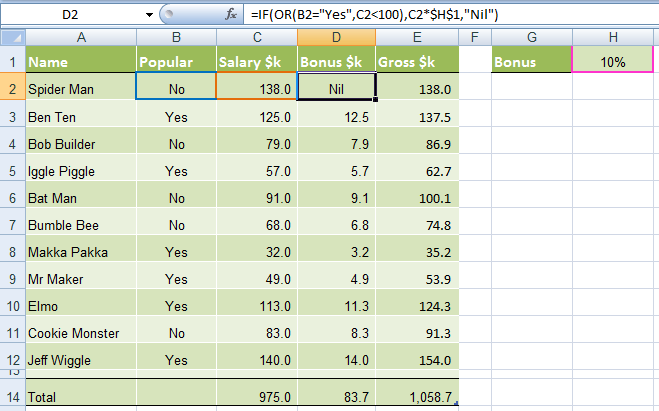

Excel If And Or Functions Explained My Online Training Hub

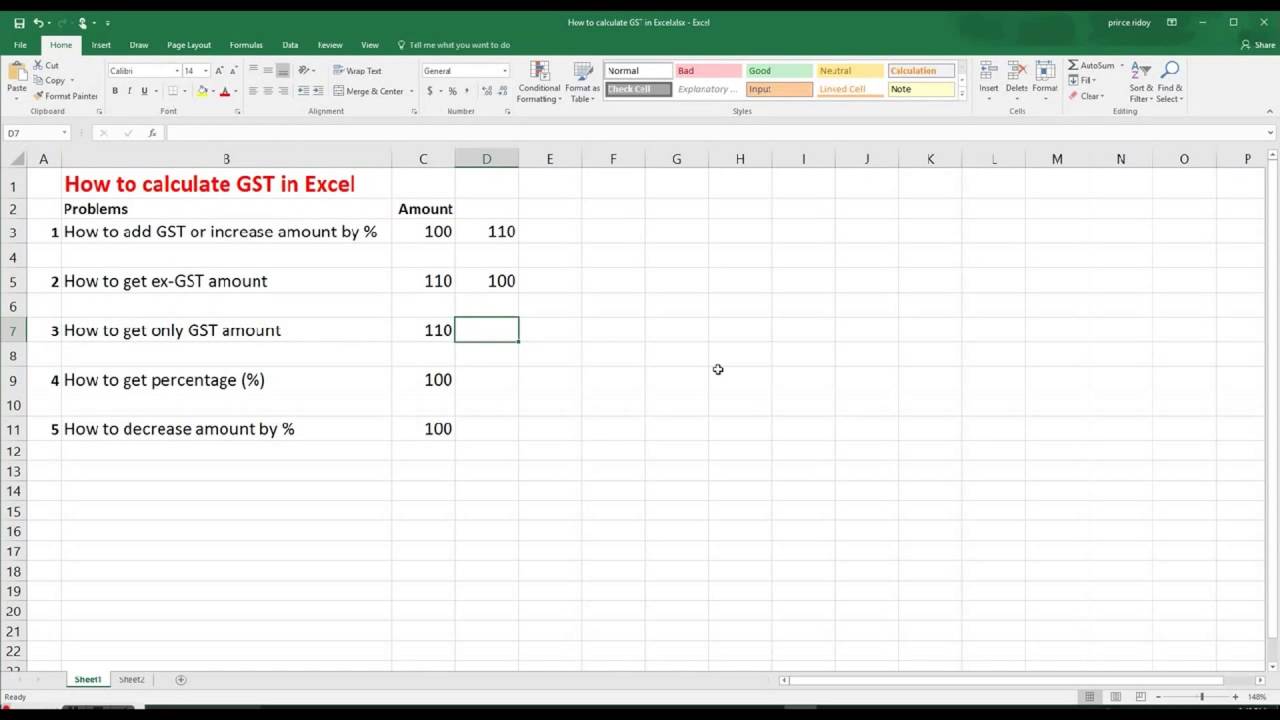

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

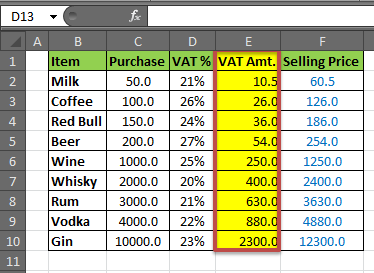

Best Excel Tutorial How To Calculate Gst

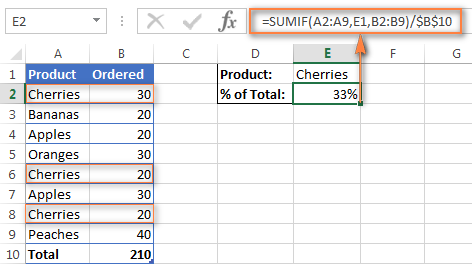

How To Keep Certain Values Constant In Excel Formulas Cell Referencing

Formulas To Include Or Exclude Tax Excel Exercise

Formulas To Include Or Exclude Tax Excel Exercise

Formulas To Include Or Exclude Tax Excel Exercise

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

5 Mis Excel Questions For Job Interviews Job Interview Questions Job Interview This Or That Questions

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

Howto How To Find Percentage Formula In Excel

Formulas To Include Or Exclude Tax Excel Exercise

How To Keep Certain Values Constant In Excel Formulas Cell Referencing